3 Easy Facts About Home Buyers Insurance Shown

Wiki Article

The Greatest Guide To Home Buyers Insurance

Table of Contents5 Easy Facts About Home Buyers Insurance DescribedThe 6-Minute Rule for Home Buyers InsuranceWhat Does Home Buyers Insurance Do?The 45-Second Trick For Home Buyers InsuranceFascination About Home Buyers InsuranceThe Ultimate Guide To Home Buyers InsuranceHome Buyers Insurance Fundamentals ExplainedThe Basic Principles Of Home Buyers Insurance Home Buyers Insurance Can Be Fun For Anyone

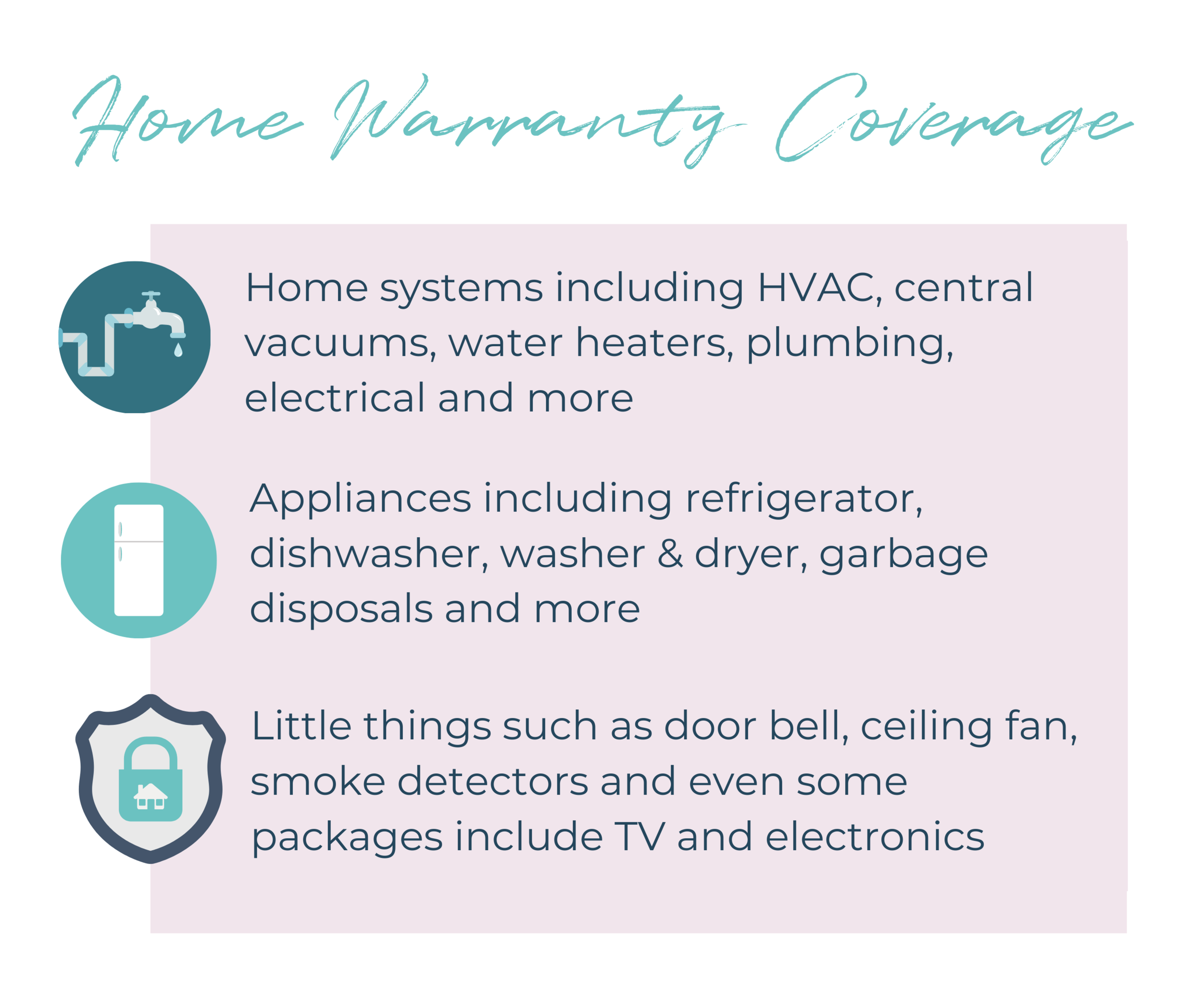

Commonly, a house service warranty covers items such as appliances, plumbing, home heating and a/c unit device, hot water heater, whirlpool bathtub, and exhaust fans. Throughout the warranty period, if you experience issues with any of the protected things, you call the warranty business. They will certainly send out a service provider to your home to detect the problem as well as determine exactly how to repair it.If the problem is covered under the guarantee, you must not need to spend for the repair service. Nonetheless, most home warranty business will certainly not deal with things that break or stop working as a result of absence of proper upkeep. And also the service warranty firm may differ with the property owner regarding what comprises correct upkeep.

The Single Strategy To Use For Home Buyers Insurance

When a house guarantee is a good suggestion If you're purchasing a home and also the vendor or home builder is supplying a cost-free service warranty, it makes feeling to take it. After all, it won't cost you anything. Nevertheless, put in the time to acquaint yourself with the fees related to utilizing the protection prior to you get in touch with the warranty firm for a solution call.If you are dedicated to normal upkeep and like the suggestion of having one point of call to supply repairs for multiple systems in your house, investing numerous hundred bucks on a home warranty might be a good deal. When a residence warranty could not make good sense Prior to you spend money on a warranty, consider other protection you may currently have.

Getting My Home Buyers Insurance To Work

As well as if your house is brand new, a home builder's guarantee might cover most of the products a home guarantee would certainly consist of. Can you pay for to pay for repair services?A yearly premium of $350 to $600 plus $50 to $125 per solution telephone call is a whole lot of cash to invest. Before you purchase a service warranty, it just makes sense to very carefully examine the protection, understand exactly how it functions, and also establish if you actually need it. The web content provided is for informative functions only.

Rumored Buzz on Home Buyers Insurance

The items covered likewise differ by company and also strategy. One firm may cover your central A/c while an additional will not. A company may provide a strategy that just covers a 2nd fridge if purchased as an add-on. Home service warranty companies also have protection restrictions and exemptions laid out in their agreements.

What Does Home Buyers Insurance Mean?

Exactly how long do home service warranties last? For the most component, home service warranty service agreements are marketed for one-year terms.The specifics rely on your agreement with the firm, but the majority of business have separate Bonuses prepare for each, as well as frequently a costs plan that consists of both. Usually talking, the technician sent out by the residence service warranty company will certainly first attempt and repair the defective home appliance or system. If that's not feasible, a replacement will certainly be procured.

The Basic Principles Of Home Buyers Insurance

As burning out as it sounds, it is imperative property owners go with the contract arrangement before purchasing a plan to see what major systems as well as devices are consisted of, as well as also to see potential reasons said items would not be covered. The home guarantee must have an example contract arrangement online. If they do not, fail to remember that business.Some business likewise have accumulated limitations: an annual cap on the amount they will pay out for any type of as well as all insurance claims. If insurance claims exceed these limits, you will have to pay of pocket. This can influence your spending plan and also your family, ought to you decide you can not fulfill this commitment (home buyers insurance).

Some Known Details About Home Buyers Insurance

It's the very best means to handle assumptions and secure your funds. What are the expenses of a residence warranty? Extensively talking, a home warranty can cost anywhere in between $300 and also $600 a year. This places the regular monthly prices in between $25 and $50. Home guarantee firms offer different plans with see this site varying costs, relying on the amount of insurance coverage that's consisted of.

Should you file a claim, you'll have to pay the solution telephone call cost associated with the repair service, a deductible that normally falls between $60 as well as $125. Are home warranties worth it? A house guarantee can supply peace of mind by covering unforeseen costs associated to systems and also devices breakdowns as well as normal tear or wear.

The smart Trick of Home Buyers Insurance That Nobody is Talking About

Who spends for house warranty, the purchaser or the seller? Vendors might pay for a residence guarantee plan to make their deal much more eye-catching as well as secure their budget while your house is on the marketplace. Property buyers can additionally acquire one from their property agent or a home service warranty carrier before shutting a deal.If you effectively take care of and also maintain your house, after that you need to be covered for every one of the above. If you have a residence security service warranty, you should feel comfy knowing that if anything goes wrong, you'll be covered by a relied on warranty service like Option Residence Warranty. However once in awhile, home owners are rejected protection, also if they have the guarantee.

Some Of Home Buyers Insurance

If, however, you maintain your residence clean and stay updated with your home maintenance, after that you'll be covered when your air conditioner or dishwasher unexpectedly breaks. Pre-existing damages If you purchased a house as look at here well as were informed of a pre-existing issue, then you will certainly not obtain this repair or substitute covered under your brand-new service warranty strategy.Report this wiki page